iedge s reit

See more on advanced chart Markets Indices. 100 REIT Source.

4 Things About The Csop Iedge S Reit Leaders Index Etf Srt Sru To Know Before Investing

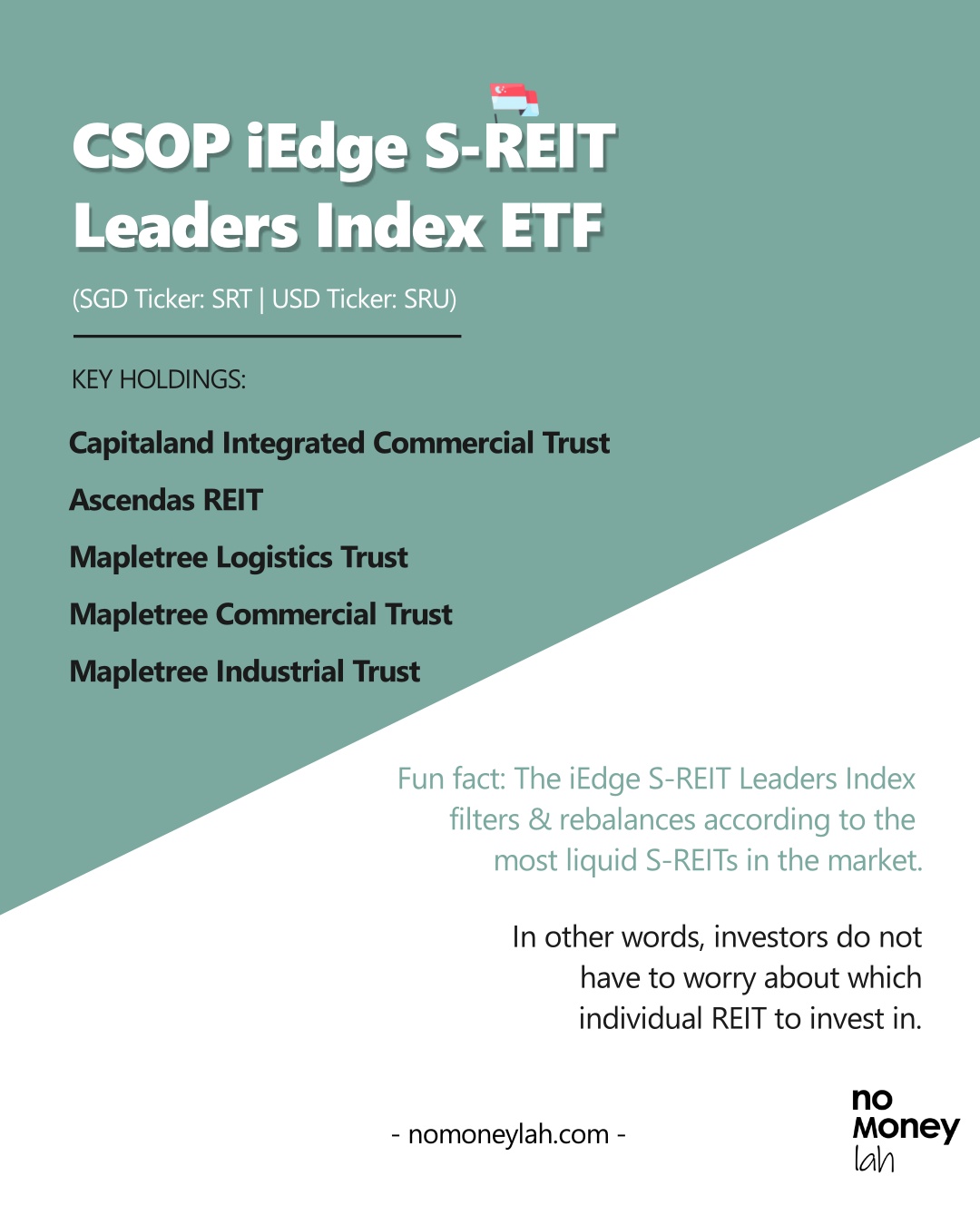

The CSOP iEdge S-REIT Leaders Index ETF is a sub-fund of the CSOP SG ETF Series I a Singapore unit trust.

. The funds manager applies an indexing-investment strategy or passive management to track its performance. Constituents must be listed on SGX and classified under Reits as defined by the Factset Revere Business Industry Classification System. View live IEDGE S-REIT INDEX chart to track latest price changes.

Launched in 2014 the iEdge S-REIT Leaders Index is an index established to measure the performance of the largest and most liquid REITs listed in the Singapore Stock Exchange SGX. The CSOP iEdge S-REIT Leaders Index ETF is available in two main currencies SGD and USD. Was the only S-Reit which received both net institutional and retail inflows for the first half of 2022.

Find the latest information on iEdge REIT REITSI including data charts related news and more from Yahoo Finance. CSOP iEdge S-REIT Leaders Index ETF Photo. Get detailed information on iEdge S-REIT Index REITSI including stock quotes financial news historical charts company background company fundamentals company financials insider trades annual reports and historical prices in the Company Factsheet.

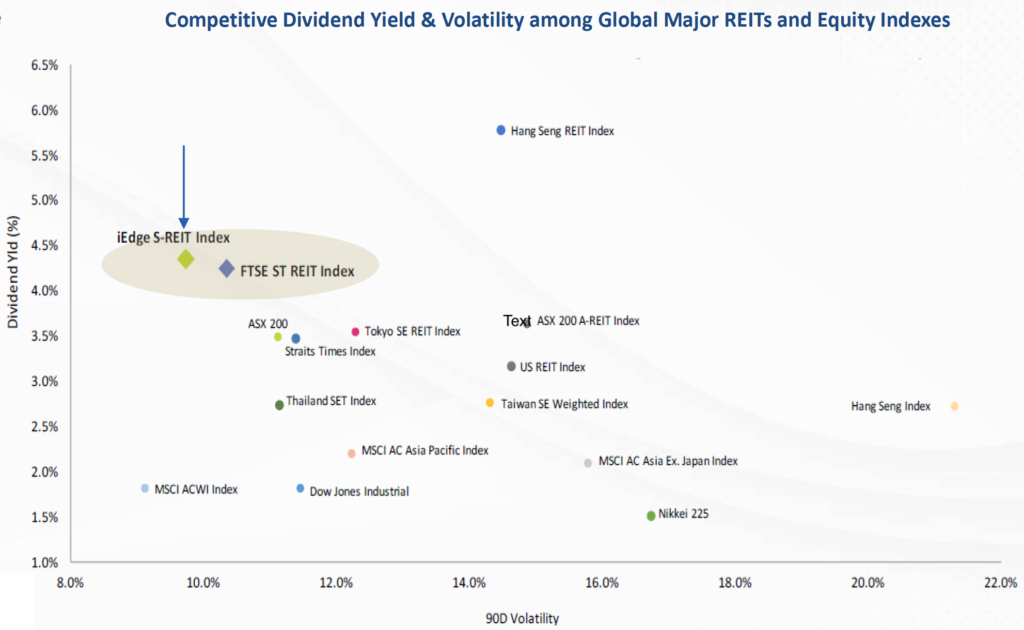

CSOP iEdge S-REIT Leaders Index ETF projects its 2022 dividend yield to be 53. CSOP iEdge S-REIT Leaders Index ETF factsheet Which means this Singapore REIT ETF projects to pay a higher dividend yield of 53. A real estate investment trust in Singapore S-REIT A fund on SGX that invests in a portfolio of income generating real estate assets such as shopping malls offices or hotels usually with a view to generating income for unit holders of the fund.

Singapore REITs A Reopening Story. Subscribe to SGX eNewsletter. Investors holding a REIT can enjoy.

IEDGE S-REIT INDEX REIT. The research houses analyst Yap Xiu Li maintained overweight on Malaysian REITs as she believed they still. With the soon to be listed CSOP iEdge S-REIT Leaders Index ETF investors will now be able to invest in S-REITs via an ETF to reap its diversification benefits.

The 9 trusts which outperformed the broader iEdge S-Reit Index in H1 2022 include 522 per cent 125 per cent 113 per cent 113 per cent 112 per cent 103 per cent 66 per cent 59 per cent and 17 per cent. The CSOP iEdge S-REIT Leaders Index ETF has a management fee of 05 and a total expense ratio of 06 which is capped and would be deducted annually as fees. In terms of sustainability of its yield from my understanding the iedge s-reit leaders index is projected to deliver a growth of 593 and a yield of 543 in 2022 according to bloomberg terminal as at 30 september 2021 and highlighted in rectangular boxes below and as the csop iedge s-reit leaders etf tracks the performance of this index.

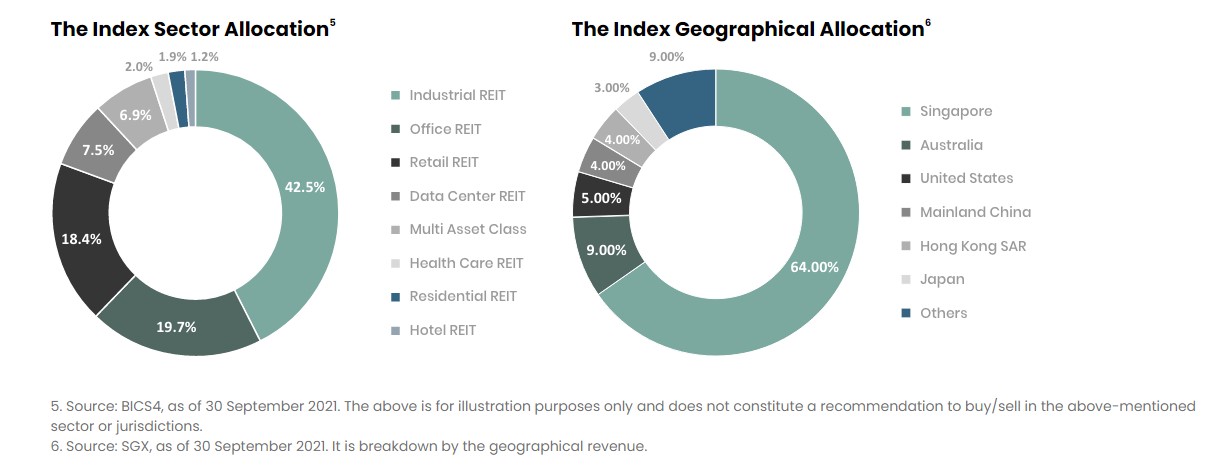

The fund tracks the performance of the iEdge S-REIT Leaders Index which mostly comprises S-REITs. Sign up to receive latest insights and news directly from our. The iEdge S-REIT Leaders Index ETF is a diversified and return-focused ETF that provides investors with exposure to some of the most important uprising industries in real estate in different geographical locations with Singapore being the.

As of 19 Jun 2022 NAV - 09364 Expense Ratio - Nil. Online subscription for the ETF is now open during the Initial Offer Period IOP online from 29 October 2021 till 15 November 2021 by 930am. The index measures the performance of the most liquid REIT in Singapore.

Liquid Real Estate Exposure. Tracks the iEdge S-REIT Leaders Index with all its constituents weights and corporate actions. SGXREIT trade ideas forecasts and market news are at your disposal as well.

As interest rates continue to be low the real estate investment trusts REITs dividend yields of 5 to 9 from 2022 onwards are attractive and will be sustained by the earnings recovery opines UOB KayHian Research. As of 31 October 2021 here are the. It has delivered an annualised return of 992 in the past 5 years and a dividend yield last 12 months of 396.

2 months 3 months 6 months 9 months 1. KUALA LUMPUR Sept 13. After paying its expense ratio of 06 thats about 47.

Business Wire A real estate investment trust in Singapore S-REIT is a fund on SGX that invests in a portfolio of income generating real estate assets such as shopping malls offices or hotels usually with a view to generating income for unit holders of the fund. 2013 2014 2016 2018 2020 0 50 100 150 200. The iEdge S-Reit Leaders Index is a narrow tradable adjusted free-float market capitalisation weighted index that measures the performance of the most liquid trusts in Singapore.

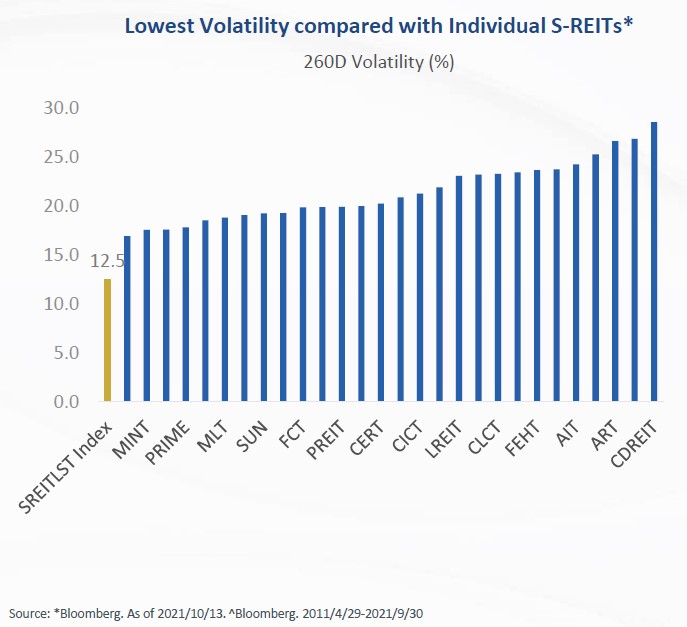

The investment objective of CSOP iEdge S-REIT Leaders Index ETF the Sub-Fund is to replicate as closely as possible before fees and expenses the performance of the iEdge S-REIT Leaders Index the Index First Trust Advisors LP. To ensure that the REITs tracked by the index are the most liquid REITs the iEdge S-REIT Leaders Index employs a liquidity-adjustment strategy. Growth Track is SGX Groups podcast series where we focus on investment and growth opportunities across Asia.

Search Ctrl K. Check out the listing ceremony of CSOP iEdge S-REITs Leaders ETF on Singapore Exchange SGX and the related information. It is a market capitalisation weighted index that tracks the performance of the most liquid REITs in Singapore.

What I dont like about this is theres no track record for this ETF. The index is one of Singapores most popular REIT indices. The iEdge S-REIT Leaders Index isnt new in fact it has been around since 2014.

The iEdge S-REIT Leaders Index consists of various notable names such as CapitaLand Integrated Commercial Trust C38U 103 and Ascendas Real Estate Investment Trust A17U 101. IEdge S-REIT Leaders Index. It tracks the largest and most liquid REITs in Singapore including household names like Ascendas REIT Mapletree Commercial Trust and CapitaLand Integrated Commercial Trust.

Declares Monthly Distribution for First Trust Enhanced Short. If youre looking to build a diversified REIT portfolio the iEdge S-REIT Leaders Index is one option to consider. Not too bad for buying a diversified REIT ETF.

Index Update Sgx S Iedge S Reit 20 Index Will Become The Iedge S Reit Leaders Index

4 Things About The Csop Iedge S Reit Leaders Index Etf Srt Sru To Know Before Investing

S Reit Report Card Here S How Singapore Reits Performed In Fy2018

Syfe Reit Vs Csop Iedge S Reit Leaders Index Etf Which Reit Investment Should You Choose

Csop Iedge S Reit Leaders Index Etf Invest In This Etf For Stable Dividend Yield No Money Lah

Csop Iedge S Reit Leaders Index Etf Poems

Csop Iedge S Reit Leaders Index Etf Invest In This Etf For Stable Dividend Yield No Money Lah

What You Need To Know About Csop Iedge S Reit Leaders Index Etf The Singaporean Investor

Reits Report Card 2021 How Singapore Reits Performed In 2nd Quarter 2021

Any Opinion Whether It S Worth Investing The New Ipo Csop Iedge S Reit Leaders Index Etf Seedly

Does Inflation And Rising Interest Rate Affect Reits Featuring Csop Iedge S Reit Leaders Index Etf Edition

Csop Iedge S Reit Leaders Index Etf Invest In This Etf For Stable Dividend Yield No Money Lah

Syfe Reit Vs Csop Iedge S Reit Leaders Index Etf Which Reit Investment Should You Choose

Constituents Of The Iedge S Reit Index Companies Markets The Business Times

Index Update Sgx S Iedge S Reit 20 Index Will Become The Iedge S Reit Leaders Index

Csop Iedge S Reit Leaders Index Etf Invest In This Etf For Stable Dividend Yield No Money Lah

Syfe Reit Vs Csop Iedge S Reit Leaders Index Etf Which Reit Investment Should You Choose

Why Singapore Reit Investors Should Consider Investing Via The Iedge S Reit Leaders Index

Comments

Post a Comment